Key takeaways

- The 2022 CHIPS Act is expected to increase domestic production of semiconductors and create high-paying R&D, design, and manufacturing jobs which presents an opportunity for early talent.

- The semiconductor industry is already beginning to build its talent pipeline - semiconductor companies have increased the internships that they are posting by 40.5% compared to the same time period the prior school year.

- Early talent is already becoming more interested in the semiconductor industry. For full-time jobs posted this school year, applications were up 79% compared to last year for semiconductor companies and only up 19% for other companies. For internships, applications were up 163% for semiconductor companies compared to 21% for other industries. This trend also holds for core tech majors, the critical talent needed to fill the expected skills shortage in the industry.

Background on semiconductor industry

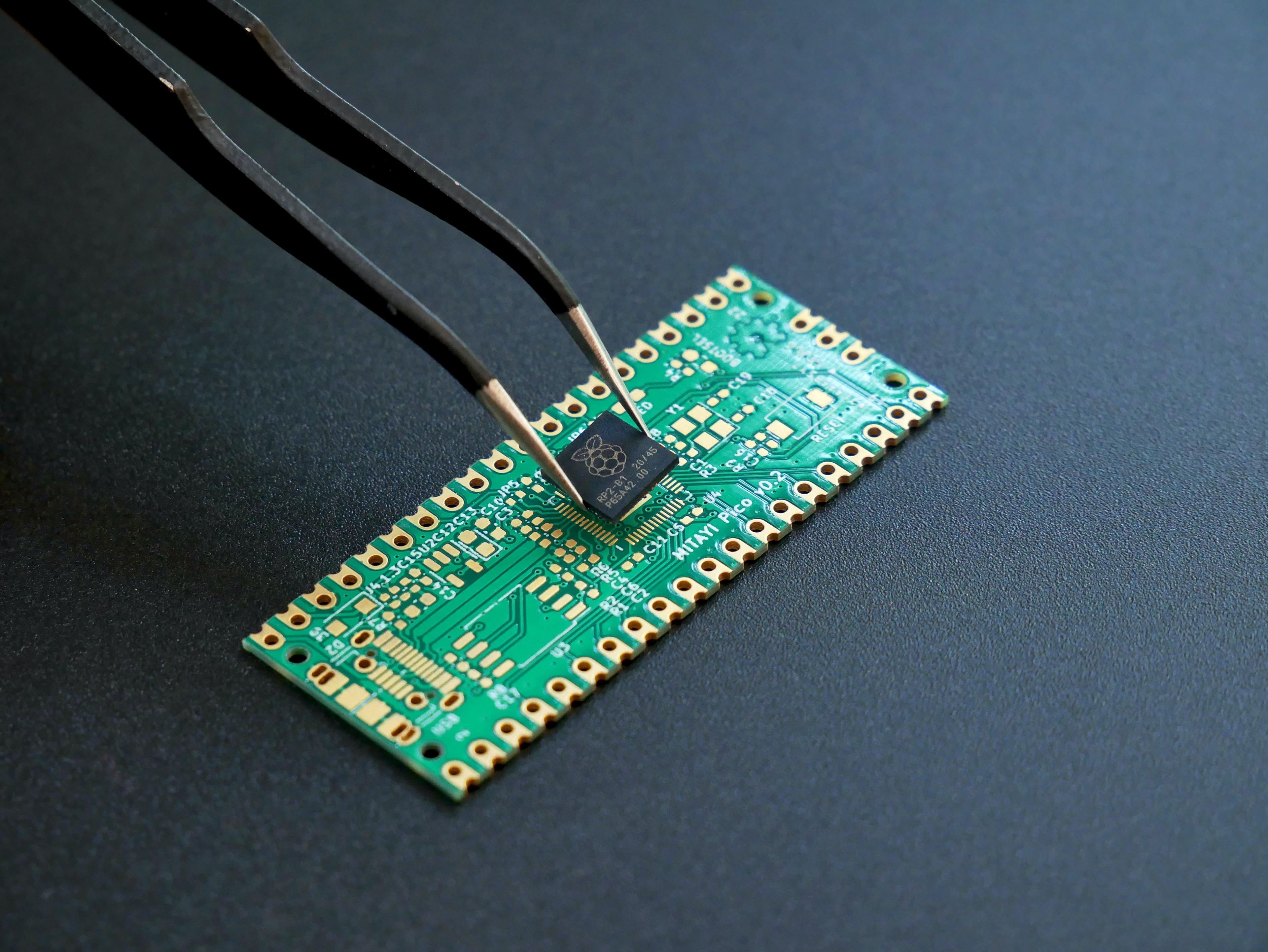

Semiconductors are an integral component in manufacturing and are used in everything from computers to automobiles. According to government statistics, only 12% of chips are currently manufactured in the United States compared to 37% in the 1990s. Many US firms are highly dependent on chips made abroad and supply chain disruption caused by COVID have highlighted the need to address fragility in supply chains. The Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022 (CHIPS Act) aims to catalyze investments in domestic semiconductor manufacturing capacity to boost US competitiveness and innovation.

A report from the Semiconductor Industry Association and Oxford Economics finds that this federal investment is expected to increase direct employment from the semiconductor industry from 277,000 workers in high-paying R&D, design, and manufacturing jobs to 319,000 workers. The impact on downstream industries that rely on semiconductors is even larger. The Act’s passage has already begun to produce the intended results, with several companies including Analog Devices (ADI), Intel, Micron and TSMC announcing investment in the domestic semiconductor industry.

Several industry experts expect that worldwide demand for semiconductors will continue to grow. McKinsey research estimates that semiconductors are poised to become a $1 trillion industry by the end of the decade. This demand will translate directly into new jobs. Deloitte estimates that by 2030, more than one million additional skilled workers will be needed to meet demand in the semiconductor industry in addition to the two million worldwide direct employees employed in 2021. They also estimate a US talent shortage of 70,000 to 90,000 workers over the next few years who will need software skills and digital skills.

This growing industry offers strong job opportunities for early talent who are just entering the labor market.

Jobs in semiconductor industry

According to the SIA/Oxford Economics report, workers in the semiconductor industry command a high wage and this premium holds when controlling for the fact that workers in the industry tend to have high educational attainment. Semiconductor industry workers earn more than workers in other industries at all education attainment levels: workers with an associate’s degree earn 65% more, workers with a bachelor’s degree earn 79% more and those with a graduate degree earn 70% more. As a result, early talent can expect to garner higher wages if they build a career in the semiconductor industry.

Opportunity for early talent

The semiconductor industry is beginning to build its talent pipeline in anticipation of the government grants that will be awarded. During the time period between September and March semiconductor companies have increased the internships that they are posting by 40.5% compared to the same time period the prior school year. Although we don’t yet see an uptick in full-time job postings for the semiconductor companies, we anticipate that we will in the future as companies carry out their commitments to invest more in the US.

Dana Gharda, Head of University Relations at ASML confirms that the semiconductor industry is entering a new era. “There is no better time than now for an engineer, developer, scientist or technician of any kind to start their career in a space where technology is challenging, demand is growing and investment is expanding,” says Gharda. “Here at ASML, we are looking for the brightest minds who are not only ready for a challenge, but want to learn and grow with us in our internship program or in a full time position.”

Handshake data highlights that early talent is also increasingly interested in these roles. While students have been applying to more jobs overall this year compared to last year, applications are up much more for semiconductor companies. For full-time jobs posted between September and February of this school year, applications up to 30 days after were up 79% compared to last year for semiconductor companies and only up 19% for other companies. For internships, applications were up 163% for semiconductor companies compared to 21% for other industries.

ADI is a global semiconductor leader that bridges the physical and digital worlds to enable breakthroughs at the Intelligent Edge. Interns and young professionals at ADI are a part of high impact professional development programs that allow them to thrive and learn from the bright minds who are dedicated to their success. In fact, ADI hires over 500 interns globally each year and converts over 60% of interns to full-time employees after graduation.

“Our people make up our DNA. That’s why we are committed to hiring great people, investing in their growth and helping them learn at every stage of their career,” said Amber Willits, Manager, Talent Acquisition (University Relations) at Analog Devices (ADI). “Our internship and early career hire program develops the next generation of talent in our communities and offers them a pathway to apply their academic skills in the real world.”

Semiconductor companies are also attracting much more interest from students who have core tech majors, the students with the software and digital skills necessary to fill the expected skills shortage in the industry. These students have increased applications 168% this school year compared to last year for full-time roles at semiconductor companies compared to 59% for other companies. For internships, students with core tech majors have increased applications to semiconductor companies by 153% year over year compared to 18% for other companies. This is a great time for the semiconductor industry, which is in need of talent, to attract early talent.

Kevin Monahan, Associate Dean and Director at Carnegie Mellon, is seeing this trend firsthand at his school. "At Carnegie Mellon, students have shown a strong interest in semiconductor companies,” said Monahan. “ASML has been recruiting talent from CMU for years and is viewed as a top employer among students. Another company, Analog Devices, attended their first CMU career fair in February and had a line of students 10+ deep during the entirety of the event."

Although the semiconductor industry is already attracting more interest from students, given the projected growth in the industry, companies and schools should start educating Gen Z now about opportunities in this industry. Additional education about the available career opportunities will help minimize the talent shortages which are projected.

Methodology

When looking at applications to Handshake job postings, we are limiting to applications within 30 days of when the job posts. In addition, students we are defining as core tech to include those with major groups of Information Systems Management, Computer Science, Computer Programming, Computer Engineering, Computer Engineering Technologies & Technicians, Business Analytics, Data Science, Data Mining, Mathematics, Statistics, Software Design, User Experience/Social Computing, Cyber Security, and Computer Systems Networking & Telecommunications.

The semiconductor industry was defined as the top 20 companies by market capitalization. The list includes NVIDIA, TSMC, Samsung Semiconductor, Broadcom, ASML, Texas Instruments, AMD, QUALCOMM, Intel, Applied Materials Analog Devices, Lam Research, Micron Technology, Synopsys, Tokyo Electron, KLA, SK Hynix, Infineon, NXP Semiconductors and STMicroelectronics.