What is a Credit Counselor?

Credit Counselors advise and educate individuals or companies on how to best manage debt.

Where does a Credit Counselor work?

- Nonprofits

- As consultants for companies

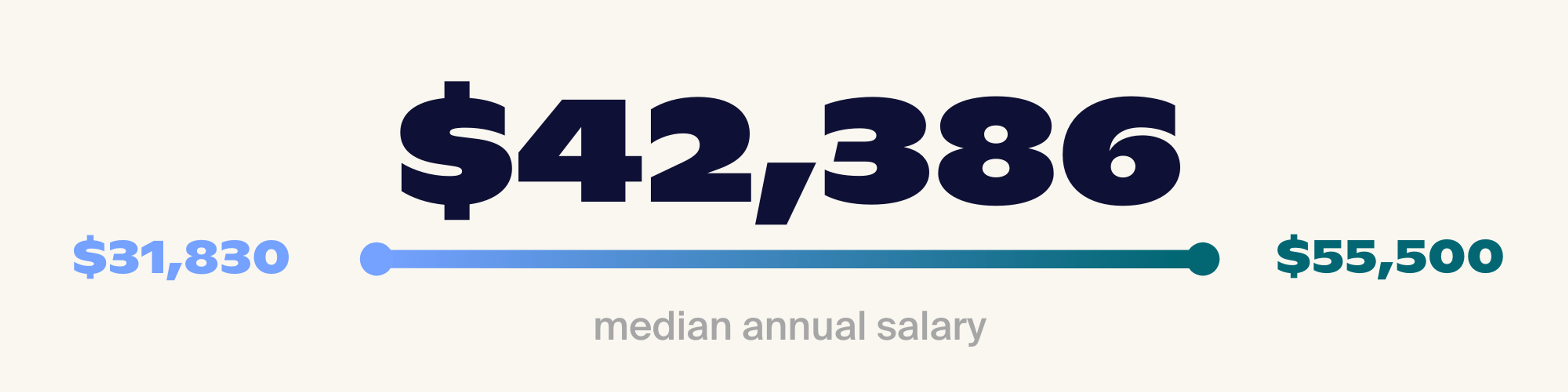

How much does a Credit Counselor make?

Based on real new grad salaries reported through Handshake, the median annual salary for a Credit Counselor is $42,386.

What majors are typically interested in becoming Credit Counselors?

One’s major doesn’t necessarily determine their career, but these are some common majors of those who end up pursuing credit counseling jobs.

- Finance majors

- Businesses majors

Credit Counselor skills and competencies:

On top of a relevant degree and formal training, here are some professional skills that can help aspiring Credit Counselor succeed in their work:

- Good communication and prompt response time

- Strong analytical skills

- Great customer service

What are some common questions about Credit Counselors?

Q: How do I become a certified credit counselor?

A: Along with your applicable degree, credit counselors must attain a certificate from a credit counseling agency or debt relief company first.