What is a Claims Adjuster?

Claims Adjusters are people who investigate insurance claims. By examining and researching the claims made in an investigation process, they can determine how liable the insurance provider is.

Where does a Claims Adjuster work?

- Insurance firms

- Third-party administrators

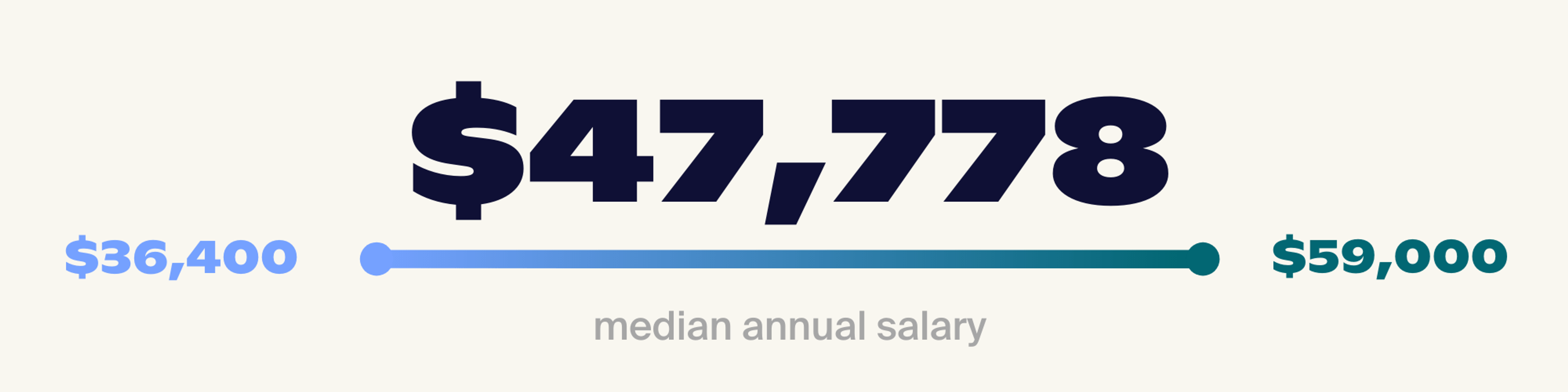

How much does a Claims Adjuster make?

Based on real new grad salaries reported through Handshake, the median annual salary for a claims adjuster is $47,778.

What majors are typically interested in becoming Claims Adjusters?

One’s major doesn’t necessarily determine their career, but these are some common majors of those who end up pursuing Claims Adjuster jobs.

- Business majors

- Accounting majors

Claims Adjusters skills and competencies:

On top of a relevant degree and formal training, here are some professional skills that can help aspiring Claims Adjuster succeed in their work:

- Strong listing and communication skills

- Emotional intelligence

What are some common questions about Claims Adjusters?

Q: Do you need a degree to be a Claims Adjuster?

A: Many employers require that you have a high school diploma or a GED to be hired as a Claims Adjuster. Others might want an associate’s or bachelor’s–it depends mainly on your employer.